Act 73 Compliance: Calculating Fair Annual Rental Value for Water Systems

by: Russ McIntosh

This article was published by Pennsylvania Municipal Authorities Association in the August 2015 issue of their magazine, The Authority.

Does your authority lease facilities from its incorporating municipality? If so, your lease payments should be carefully documented and calculated to ensure you are in compliance with Act 73, or a potential legal challenge could result.

Background

Passed in 2012, Act 73 added Section 5612 (a.1) to the Municipal Authorities Act, restricting the use of authority funds for

“any purpose other than a service or project directly related to the mission or purpose of the authority as set forth in the articles of incorporation or in the resolution or ordinance establishing the authority…”

Some authorities are obligated to make lease payments to the municipality that owns the facilities they use to provide service. While payments for the use of facilities operated by the authority to provide its services would seem to satisfy the “mission or purpose” requirement, deciding on the amount of that payment could be problematic. If the fee is too high – beyond a fair market value – rate payers could argue that the excess funds are not being used for a purpose directly related to the authority’s mission. And under Act 73, they could make that argument in court:

“A ratepayer to an authority shall have a cause of action in the court of common pleas where the authority is located to seek the return of money expended in violation of paragraph (1) from the recipient.”

Operating authorities that lease their facilities are not as common as straight operating or leaseback authorities. Although there have been no legal challenges to date, other recent changes in the act that allow for stormwater authorities may expand the applicability of the Act 73 amendments.

Act 68 of 2013 added Section 5607 (a) 18 to the act and extends the power of authorities to allow for:

“Storm water planning, management and implementation as defined in the articles of incorporation by the governing body. Authorities, existing as of the effective date of this paragraph, already operating storm water controls as part of a combined sewer system, sanitary sewer system or flood control project may continue to operate those projects.”

This may generate a need for more authorities to lease their facilities since the majority of storm water facilities are owned by the municipalities who remain responsible for compliance with their Municipal Separate Storm Sewer Systems (MS4s) permit. Authorities have the ability to impose fees and charges for storm water service, which may provide a convenient vehicle for funding these systems with user charges instead of general fund tax revenues without having to actually transfer ownership of the facilities. Authorities may also be useful in establishing drainage basinwide charges without having to seek regulatory approval.

Fair Annual Rental Value Calculation in Practice: Reading Area Water Authority

Recently HRG was selected by the Center for Excellence at Albright College to perform a study for the Reading Area Water Authority (RAWA). The work required HRG to calculate the fair annual rental value of the water facilities RAWA leases from the City of Reading. The calculation was needed in order to make sure that the payments required under RAWA’s lease with the city met the requirements of the Municipal Authorities Act as amended by Act 73 of 2012.

The mission of the Center for Excellence in Local Government at Albright College is “to maintain and enhance the quality of life in Berks County by assisting municipal leaders in meeting the changing needs of their communities.” RAWA is an operating authority that serves a population of approximately 150,000 in the city and portions of the surrounding municipalities. It delivers approximately 15 million gallons of water each day and has an annual budget of $27,000,000. It leases facilities from the city, and lease payments to the city represent about one-third of its annual budget.

Approach and Methodology

While a few systems have been leased to third parties such as the Allentown wastewater system to the Lehigh County Authority and the Borough of Middletown’s water and wastewater systems to United Water of PA, these leases have an entirely different objective and a structure that provides an up-front, lump-sum payment for a fixed term. There is no reliable public market that determines the “fair annual rental value” of a utility system and no single formula for determining this value. Instead, fair annual value calculations must consider:

- The value of the assets employed in rendering the service

- The existing financial structure of the utility

- Market interest rates

- Opportunity cost

A lease payment that represents the fair rental value of the system, the amount that a willing lessee would be willing to pay a willing lessor on an annual basis, needs to consider a variety of factors.

These factors include:

- Asset base

- Outstanding debt

- Necessary reinvestments

- Return on investment

- Cash flow

In the case of Reading, the city owns the facilities and made significant investments in the water system over time in order to comply with regulatory mandates and protect the public health and safety of those who purchase water from RAWA. From the city’s point of view, the fair annual rental value should be based on the value of the assets and a reasonable rate of return consistent with their risk. It should also consider likely future events, such as the need to make additional investments to keep facilities updated and to accommodate the future growth. Such calculations are made independent of the actual revenue being generated by those assets.

From RAWA’s point of view, the fair annual rental value needed to reflect the system’s cash flow or user rates would need to be increased. RAWA’s mission is to charge users reasonable and uniform rates consistent with the level of service provided. Rates and charges are RAWA’s only source of income and must generate sufficient funds each year to pay all the expenses of the system, including operation and maintenance expenses, debt service, the annual rental payment to the city, and necessary capital investments.

Balancing both points of view, our analysis considered the current net book values of the water system’s assets and also considered the current replacement value of those assets. Other assets such as water rights were considered in the calculation where appropriate. Assets were looked at in total and adjusted for investments in facilities financed by RAWA bonds. Appropriate rates of return were calculated and applied.

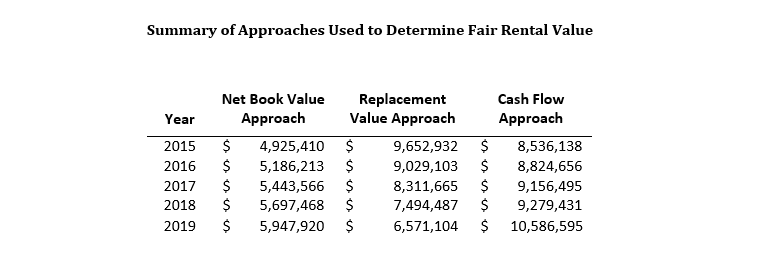

We also considered the projected cash flow from operations using current rates adjusted for cash needed for reinvestment in capital assets. Future rate increases, the impact of customer growth and regulatory, environmental, and safety compliance were important factors in determining future cash flows. We selected a five year period, 2015 through 2019, in order to measure the sensitivity of the annual fair rental value of these factors on water rates.

Using Multiple Calculation Methods to Determine Fair Annual Rental Values

HRG used multiple methodologies in order to blend the desire of the lessor (the city) to obtain the highest rent possible with that of the lessee (RAWA) to provide service at reasonable and uniform rates while meeting all financial obligations. In this way, we tried to approximate the amount that a willing lessee would be willing to pay a willing lessor.

- Book Value Method: HRG evaluated the net asset values as the basis for calculating the fair annual rental, then applied rates of return commonly allowed in regulated utility cases for similar municipally owned water utilities. Typically, the PUC distinguishes between capital provided through debt financing and capital provided by investors when considering the overall return on investment that can be included in the rates. Various utility specific factors are considered, and expert testimony may be required when determining the rates of return allowed.

- Replacement Value Method: Our analysis also considered replacement cost as a basis for calculating the fair rental value of the system. Replacement value, in this instance, is used to approximate the opportunity cost associated with holding an asset that has appreciated in value. It is important to note that in order to actually realize the benefit of the appreciated asset values, it would be necessary to convert those values into cash or other assets. Accordingly, our approach did not simply apply the rate of return on equity to the equity value created through use of replacement cost; rather, net equity was determined and a composite rate applied.

- Cash Flow Method: Like our other approaches, this method has its limitations, since available cash flow measures the difference between revenues received and expenses paid, including necessary reinvestments in the system included in the current budget or future debt service. It is sensitive to changes in the rates charged for services, general price level changes and any imbedded operating inefficiency. In order to compensate for the limitations in the cash flow approach outlined above, we obtained water rate information from surrounding water systems and systems serving metropolitan areas similar to Reading in order to measure RAWA’s ability to increase rates to meet current and future lease rental costs.

Each method represents a valid approach for a particular purpose. Investors in investor-owned utilities are compensated for their investment in two ways: the rate of return allowed and collected through the utility’s rate structure (which is often paid out as a cash dividend) and the change in the value of their shares of stock. This is not true for municipally owned utilities where there is no capital stock or dividends. There is no ability to “sell” the equity created by an increase in the utility’s economic value without impacting the ratepayers.

Applying return on the current replacement cost method allows for the introduction of the increased economic value into the calculation. And, as can be seen in the table below, the values are higher even after calculating the return on the net realizable value. However, it is our belief that the cash flow method, while not perfect, provides the best overall measure of the current economic value on which to base the annual fair rental value of the water system.

Our use of multiple calculations provided a range of fair annual rental values. This was especially useful when looking at these calculations for a multi-year period.

Based on our analysis, we concluded that the annual fair rental value for the water system is $9,275,000 per year. This value represents the projected annual average cash flow value of the system yielding an average rate of return on the net book value of the city’s investment in net assets of 6.83% or 3.03% on net replacement book value. The return on net book value of 6.83% is within the rate of return range for investor-owned public water utilities. The lower rate of return calculated using replacement values is consistent with market rates for safe investments in today’s economic environment such as 20-year US Treasury Bonds.

Conclusion

While our study addressed the specific needs of RAWA and the city, each utility system is different. The passage of Act 68 authorizing stormwater authorities will likely involve transfer or lease of existing, municipality-owned stormwater facilities to an authority. Given the language of the Act 73 amendment, some due diligence would seem to be warranted when payments are being made by an authority to a municipality. Not all annual fair rental value calculations will require the use of multiple methods. However, in order to avoid a potential legal challenge, proactive authorities should examine their lease payments to ensure they are in compliance with the law.