Smart Fiscal Controls for Municipal Authorities

See how to protect your utility from employee theft and ensure you have procedures in place to sustain your system for the long term.

October 2019 /

New legislation is changing how municipal authorities handle the money they collect and how they report their financial activity each year. Do you know what this means for your utility?

In May, Governor Wolf signed an amendment to the Pennsylvania Municipal Authorities Act named Act 4 of 2019. This bill requires municipal authorities to deposit all monies they collect into an account with a designated depository. It also requires that money be remitted in the name of the authority and not include the name of an individual.

According to the bill’s sponsor, State Representative Zachary Mako, these requirements are intended to protect customers’ money from embezzlement.

“I took up this mantle because I have always been a proponent for good-government bills that add an extra layer of protection on the hard-earned money of taxpayers,” Mako says. He was concerned about reports he’d read of an embezzlement case in Western Pennsylvania and another in Southeastern Pennsylvania, in which authority employees had stolen more than $100,000.

In the Southeastern Pennsylvania case, the woman charged with embezzlement had been the authority’s only full-time employee. She alone was responsible for collecting funds, depositing them in the bank, and completing secretarial duties.

This is something municipal authorities should avoid, according to a panel of experts who spoke about embezzlement at the Pennsylvania Municipal Authorities Association conference in 2017 and 2018. Ideally, the responsibilities for handling money should be segregated among multiple employees: Responsibility for receiving cash should be separate from responsibility for disbursing cash. Responsibility for disbursements and approvals should be separate from responsibility for recording entries. Duties of cashiers taking payment should be segregated from bank reconciliation, accounts payable, and general accounting.

When an authority relies on only one person for these functions, they are more vulnerable to theft.

While most municipal authorities already segregate duties in this way, small utilities often don’t have the staff available to do so (nor do they have the rate base to support a larger staff). For them, the requirements in this bill provide a certain layer of protection without imposing unmanageable staffing obligations.

Act 4 of 2019 also requires authorities to present an annual audit and financial report at a public meeting and have that report formally accepted by a vote of the authority’s board.

This transparency ensures that the public knows how the money they pay for service is being used and is aware of the authority’s financial health. A formal vote to accept the report reinforces the board members’ responsibility to be good stewards of this money.

In our experience working with dozens of municipal authorities, we have found that most are already following these procedures and have even more stringent controls in place beyond the requirements of the law.

At HRG, we recommend additional measures to make sure a municipal authority is on strong financial footing:

Pass resolutions to formalize any unwritten procedures you have in place. (This ensures everyone on staff has a consistent understanding of procedures and provides additional transparency to the rate payers and incorporating municipality.)

Perform studies and have documentation on file to support the rates and fees you have in place.

Review revenue and expenses annually to verify that existing rates and charges are enough to be sustainable for the long-term.

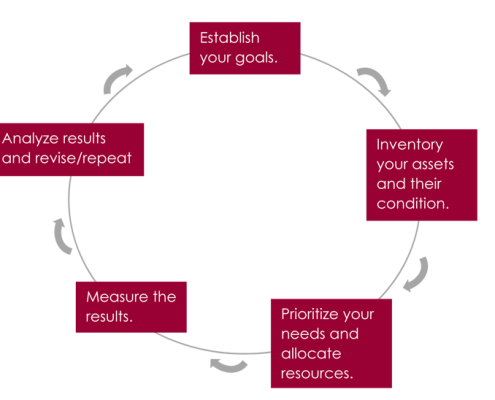

Consider an asset management and capital improvement program to help you identify and budget for long-term repair and replacement needs in advance. Asset management and capital improvement planning helps you maximize the life cycle of your infrastructure in the most cost-effective way possible. (Learn more about the benefits of asset management and capital improvement planning.)

Herbert, Rowland & Grubic, Inc. (HRG) can assist with all of these tasks. Contact a member of our financial services team to evaluate your authority’s financial procedures, review revenue and expenses, or discuss long-term capital improvement planning:

Herbert, Rowland & Grubic, Inc.

Herbert, Rowland & Grubic, Inc.